Earned income credit calculator

Use this calculator to find out. Earned Income Tax Credit Calculator.

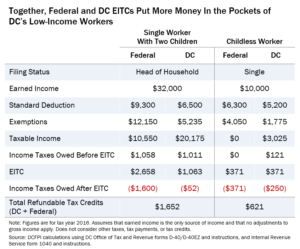

Dc S Earned Income Tax Credit

If you qualify you can use the credit to reduce the taxes you owe.

. This table is here to provide an estimate of the earned income tax credit. This 2021 Earned Income Tax Credit calculator is for Tax Year 2021 only. Required Field Of this other income how much came from investments.

The Earned Income Credit EIC is a refundable tax credit available to working individuals with low to moderate incomes. The earned income credit which may also be referred to as the Earned Income Tax Credit EITC is a refundable tax credit. Earned Income Credit EIC Calculator.

Colorful interactive simply The Best Financial Calculators. The legislation allows taxpayers who earned less than 150000 in adjusted. The EIC or EITC is a refundable tax credit for taxpayers who have low or moderate incomes.

The Earned Income Tax Credit EITC helps low to moderate-income workers and families get a tax break. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break. Ad View your latest Credit Scores from All 3 Bureaus in 60 seconds.

Find additional assistance from the experts at HR Block. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. Get a branded for your website.

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current. Earned Income Credit EIC is a tax credit available to. Lower income earners may be eligible for EIC or Earned Income Credit a tax refund that returns money to families and individuals under a certain income level.

If youre eligible for the. Earned Income Credit EIC Calculator Earned Income Credit EIC is a tax credit available to low income earners. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

EIC Earned Income Credit Calculator. Answer some questions to see if you qualify. Earned Income Credit Calculator.

Have worked and earned income under 57414. Earned Income Tax Credit Calculator. In some cases the EIC can be greater than your total income tax bill providing.

This credit is meant to. The credit amount depends on your income marital status and family size. The credit amount rises with earned income until it reaches a.

The EIC reduces the amount of. Earned Income Credit Calculator 2021 2022. The Earned Income Tax Credit still proves that tax filers will depend on this credit.

This credit is meant to. The Earned Income Tax Credit - EITC or EIC. To qualify for the EITC you must.

Use the Earned Income Tax Credit calculator from the IRS to see if you qualify for the EITC. The Earned Income Tax Credit - EIC or EITC - is a refundable tax credit for taxpayers who have low or moderate incomes. The Foreign income conversion calculator will convert your foreign income into Australian dollars using either a.

Find out how much you could get back Required Field. In 2021 the credit is worth up to 6728. Ad Get Help maximize your income tax credit so you keep more of your hard earned money.

Have a valid Social Security. The earned income credit. Enter your filing status number.

Tips Services To Get More Back From Income Tax Credit. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. The Earned Income Tax Credit EITC is a refundable tax credit designed in part to reduce the tax burden on low-income.

Use the EITCucator Dollar Amount tool below to help you determine how much your Earned Income Tax Credit may be with your 2021 Return due in 2022. Have investment income below 10000 in the tax year 2021. Build Your Future With a Firm that has 85 Years of Investment Experience.

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

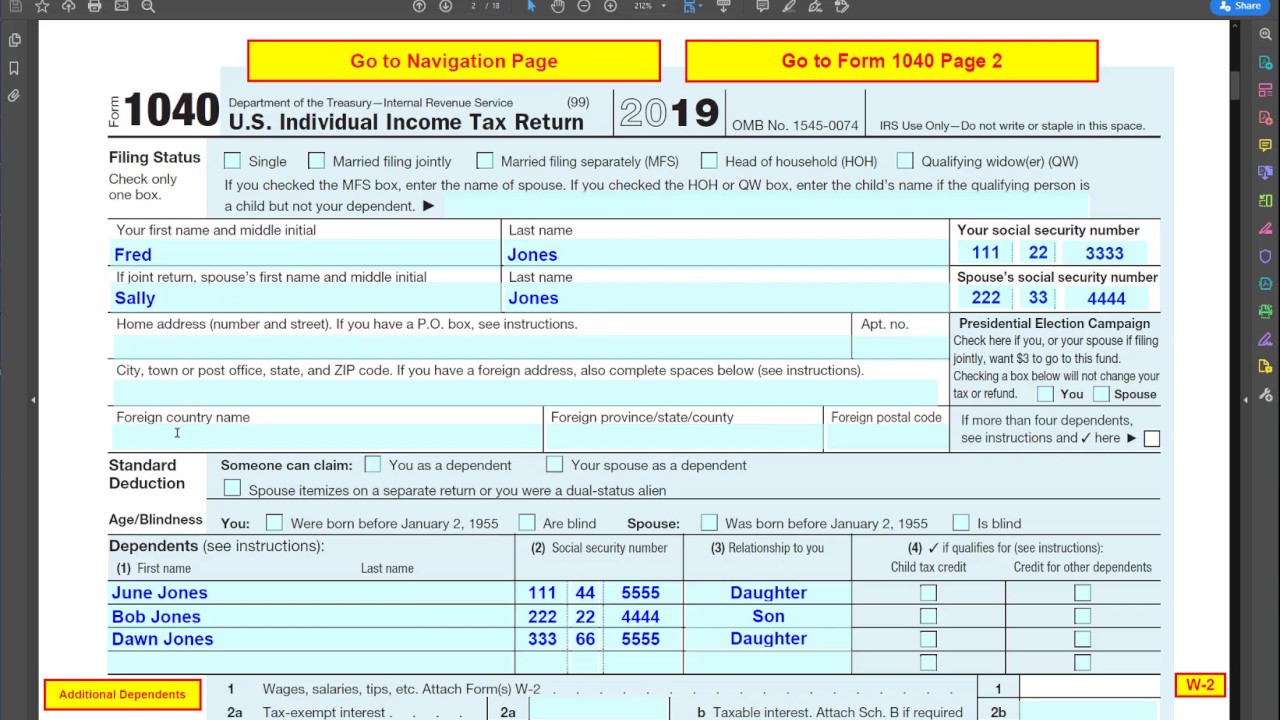

Form 1040 Earned Income Credit Child Tax Credit Youtube

Proposal Evaluation Criteria Template Risk Management Hr Management Human Resources

Earned Income Tax Credit Parameters 1975 2000 Dollar Amounts Download Table

Pin On Finance Fun

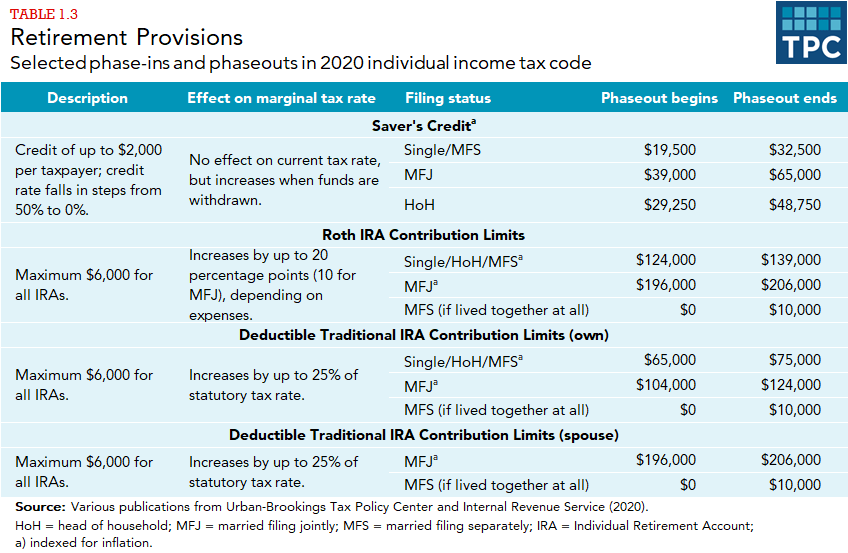

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

The Distribution Of Tax And Spending Policies In The United States Tax Foundation

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Here S What You Need To Know About The Earned Income Tax Credit In 2021

Eic Frequently Asked Questions Eic

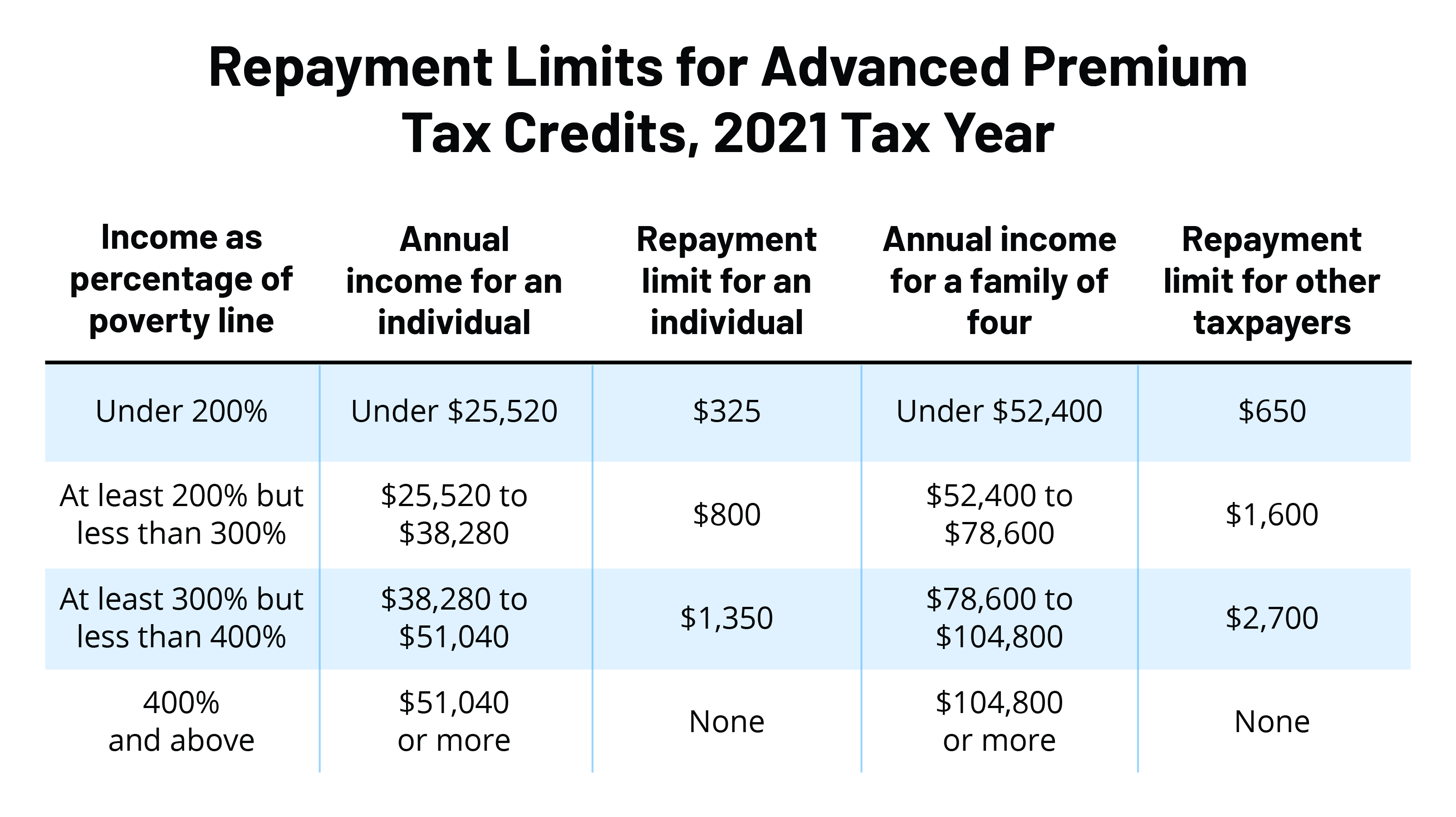

What S The Most I Would Have To Repay The Irs Kff

Pin On Finance And Investment

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

Earned Income Tax Credit Eitc Refinance Loans Mortgage Interest Rates Financial Ratio

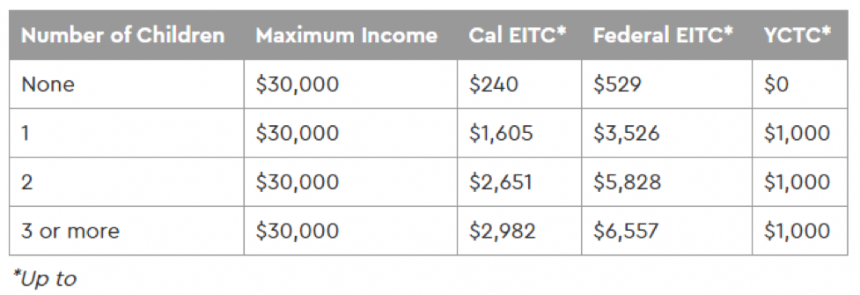

California S Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

What Are Marriage Penalties And Bonuses Tax Policy Center